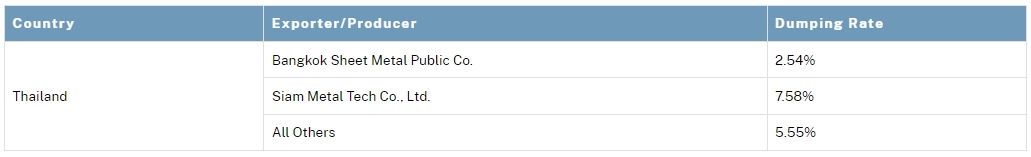

What is good news for us and our customers! According to the latest news released by the U.S. International Trade Administration, we only need to pay an anti-dumping tax of 5.55% for exporting boltless steel shelving from Thailand, which is much lower than we expected.

Recently, the U.S. International Trade Administration published an article on its official website titled: "Preliminary Affirmative Determinations in the Antidumping Duty Investigations of Boltless Steel Shelving from Malaysia, Taiwan, Thailand, and the Socialist Republic of Vietnam, and Preliminary Negative Determination in the Antidumping Duty Investigation of Boltless Steel Shelving from India".

The article mentioned that through investigation, the Preliminary Dumping Rates of India were 0.

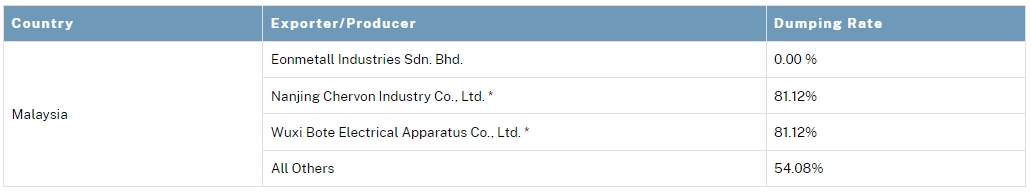

In Malaysia, only Eonmetall Industries Sdn. Bhd. has an anti-dumping duty of 0, other companies have an anti-dumping duty of 54.08%, and two companies have anti-dumping duties as high as 81.12%.

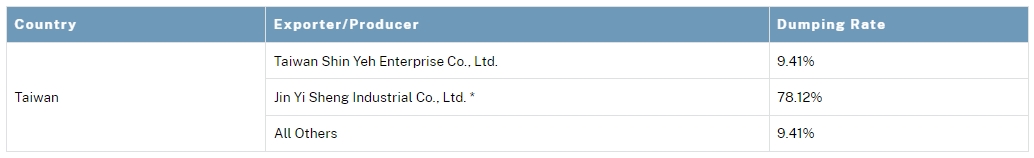

In Taiwan, only Jin Yi Sheng Industrial Co., Ltd.'s anti-dumping duties are 78.12%, and the anti-dumping duties of other companies are 9.41%.

Thailand's overall anti-dumping tax rate is between 2.54% and 7.58%.

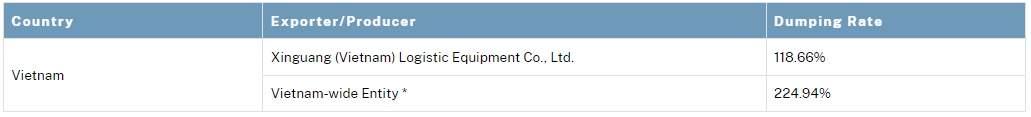

There are two companies in Vietnam with anti-dumping duties exceeding 100%.

ITC Final Determinations will be announced on or about May 28, 2024.

On the official website of the United States International Trade Administration, we found the formula for calculating the dumping margin. Let us learn it together.

Key Elements of the Dumping Allegation: U.S. Price: the price of the foreign merchandise sold or offered for sale in the U.S. market. Normal Value: the price of the same merchandise sold or offered for sale in the foreign producer’s home market, or, if home market prices are unavailable, the price of the foreign merchandise sold or offered for sale in a third country market. In some cases, the normal value is based on the foreign producer’s cost of producing the merchandise. Dumping Margin: the amount by which the normal value exceeds the U.S. price of the foreign merchandise, divided by the U.S. price: (Normal Value - U.S. Price)/U.S. Price

Post time: Nov-28-2023